Preliminary Financial Report FY20

One of the City Controller’s primary responsibilities is analyzing and reporting on the City’s financial health. The Preliminary Financial Report, made available each October after the City’s books are closed, is the first of such report each year. It provides information on how the City spent its money over the past fiscal year, with data and analysis of the City’s revenues and expenditures, reserves and bonded indebtedness. As this report is the first to capture the initial impact of the COVID-19 pandemic, it shows a glimpse of the economic challenges to come. Scroll below to view the report summary with interactive data visualizations, followed by the full text of the report.

Revenues

During the 2019-20 fiscal year, revenue grew by 2.3% in the General Fund and shrank by -2% in on-budget special funds. The COVID-19 pandemic caused revenues to come in 3.7% short of projections. View this interactive data visualization to explore the relative size of the City’s revenue sources and their growth over the past 10 years.

Expenditures

Total expenditures grew at a rate of 10%, due in large part to salary and benefit increases and capital improvement projects. This interactive data visualization compares the expenditures of the City’s different departments, as well as non-departmental expenditures, over the past 10 years.

Reserves

The Reserve Fund is established to ensure that funds are available for unanticipated expenditures and revenue shortfalls in the General Fund. The City’s Reserve Fund Policy sets a goal for the Reserve Fund of at least 5% of the General Fund budget every year. On July 1, 2020, the Reserve Fund had a balance of $262.5 million, 3.93% of the General Fund budget and below the 5% Reserve Fund Policy goal.

The Budget Stabilization Fund (BSF) was added to the City Charter in 2011. The purpose of the BSF is to set aside funds when revenue projections are exceeded to help smooth out years when revenue is stagnant or is in decline. In fiscal year 2020, the BSF grew slightly to $107.2 million but stayed about flat as a percentage of General Fund revenues. Click the chart below to view the performance of the Reserve Fund and Budget Stabilization Fund, both in dollar terms and as a percentage of budgeted General Fund revenues.

Debt

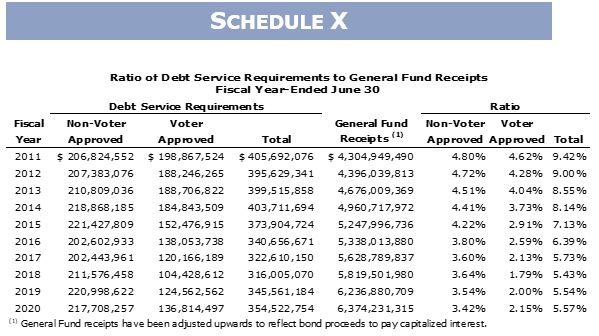

The City’s debt management policy establishes guidelines for the structure and management of the City’s debt obligations. These guidelines include a non-voter-approved debt service cap of 6% and a total debt service cap of 15% as a percent of General Fund revenues. The City’s total indebtedness and debt service obligations increased slightly to 5.6% last fiscal year.

To address looming financial issues, the following recommendations are set forth in the Preliminary Financial Report:

- Focus on revenue and limit spending: While tourism-related revenues dropped, the City must work harder to collect from its other revenue streams and collaborate with stakeholders to prevent further spending increases.

- Rebuild the Reserve Fund: To balance the budget, the City transferred nearly $200 million from its reserves to the General Fund, highlighting the need to rebuild this critical resource, which exists for emergencies like this.

- Leverage City properties and special funds: The City owns hundreds of unused or underutilized properties and has billions of dollars in special funds. Policymakers should determine whether either can be used to improve the City’s financial position and help local residents.

- Expand infrastructure programs to rebuild communities: Given the present revenue crunch, the City should explore debt financing opportunities to create jobs through infrastructure projects, including street and sidewalk repair and information technology modernization. These efforts should be concentrated in areas of the City most impacted by COVID-19 and historically disadvantaged communities to achieve greater equity throughout Los Angeles.

Cover Letter

October 21, 2020

Honorable Eric Garcetti, Mayor

Honorable Members of the Los Angeles City Council

Re: Preliminary Financial Report for Fiscal Year 2019-20

The Controller’s Office submits the Preliminary Financial Report each fall to look back at the City of Los Angeles’ financial operations for the prior fiscal year. Our report is the City’s first review of municipal finances after the close of the fiscal year, providing an overview and analysis of revenues and expenditures, reserves and bonded indebtedness. In early 2021, my office will follow up by issuing the City’s Comprehensive Annual Financial Report for 2019-20, which is prepared in accordance with Generally Accepted Accounting Principles and audited by an independent firm of certified public accountants.

Accompanying the Preliminary Financial Report is an online interactive tool for exploring revenues and expenditures, with 10 years of data, which can be found at lacontroller.org/pfr2020. Information on special fund balances and uses, Reserve Fund starting balances over the years, and budget appropriations, adjustments, expenditures and revenues, are also available on our website.

The report is prepared to help City leaders understand and assess the health of and challenges facing the City’s finances — an especially indispensable task given that we are still in the throes of the COVID-19 pandemic. Despite the unique nature of this economic downturn, assessing the initial stages of the impact of the coronavirus on the City’s revenues and expenditures, reserves and outstanding debt — all of which are discussed in the report — are critical to navigating the current fiscal year and those just ahead, while highlighting the absolute need for continued responsible financial management.

Good year gone bad

Highlighted in the Preliminary Financial Report are these facts about the 2019-20 fiscal year:

- Fiscal year 2019-20 experienced strong revenue growth during the first three quarters, with General Fund revenues growing 7.5 percent ($300.3 million) over the same period in the prior year;

- But the enormous disruption caused by the coronavirus resulted in final General Fund revenues coming in $196 million (3 percent) under the adopted budget and $143 million (2.3 percent) over the previous fiscal year;

- The drop in travel and hospitality caused Transient Occupancy Tax revenue to plummet 22.4 percent ($73.1 million) below the budget and 20.5 percent ($65.3 million) less than the year prior;

- Total expenditures and encumbrances grew at a rate of 10 percent overall as a result of salary increases and capital improvement projects. Responding to the public health crisis further stressed the City’s finances;

- The pandemic showed how essential reserves are to the City and the need to build them during growth years. Starting fiscal year 2019-20 at 6.2 percent of General Fund receipts, the needs of balancing the budget required the transfer of $195.5 million to the General Fund, causing the Reserve Fund balance to drop below the five percent policy threshold at the beginning of the current fiscal year. Despite this, it still remains a resource that the City must monitor closely to ensure funds remain on hand if additional emergency funding is needed.

Uncertainty reigns

While the report reviews last fiscal year’s numbers, there are glaring concerns that impact the City’s overall financial outlook. Now, as we near the midpoint of the current fiscal year, the scope of any near-term economic recovery remains highly uncertain, casting doubt on revenue projections and expenses. This is a major risk that must be considered throughout the fiscal year as the City Council revisits the budget, which must be done regularly to maintain fiscal balance and respond to the difficulties ahead. In addition, expenditures will continue to grow due to increased salary and employee benefit costs. Such costs will put constraints on the City’s ability to maintain services, especially if revenues do not begin to recover quickly. To proactively address these issues, my office recommends that the City further remain cautious when considering future staffing and related spending requests.

Use debt financing to boost equity

The City’s debt service requirements increased slightly to 5.6 percent of General Fund revenues, but remained considerably below the policy limit of 15 percent. Given the present revenue crunch, the City should consider exploring additional debt financing opportunities, which could help create jobs through large-scale infrastructure projects, including street and sidewalk repair and information technology modernization to improve broadband access. These efforts should be concentrated in areas of the City that have been disproportionately impacted by COVID-19 and in historically disadvantaged communities to achieve greater equity throughout Los Angeles.

My staff and I appreciate the cooperation shown by City departments as we prepared this report. Should you have questions or need more information, please contact my Director of Financial Analysis and Reporting, Matthew Crawford: (213) 978-7203 or matthew.crawford@lacity.org.

Respectfully submitted,

RON GALPERIN

L.A. Controller

cc: Sharon Tso, Chief Legislative Analyst

Richard H. Llewellyn Jr., City Administrative Officer

Executive Summary

At the close of each fiscal year, the Office of the Controller reports on the finances of the City for the year that just ended. This Preliminary Financial Report is the first piece of that reporting and provides cash basis information on revenues, expenditures, reserves, and bonded indebtedness, including comparisons to the prior year and to the Budget.

The second piece of this reporting requirement is the Comprehensive Annual Financial Report (CAFR), the City’s official, audited financial statement, which will be released later this fiscal year. Together, these two documents educate and inform both City decision-makers and the public on the City’s financial situation.

A Good Year Gone Bad

Fiscal Year 2019-20, which ended on June 30, 2020, experienced strong revenue growth over the first three quarters of the year, with General Fund revenue growing 7.5 percent ($300.3 million) over the same period in the prior year.

The Coronavirus pandemic has brought about widespread economic disruption, causing a wave of job losses and ending the longest expansion since World War II. After three solid quarters of revenue growth, revenues reacted to the economic shutdown in the fourth quarter, resulting in final revenues $196 million under the budget, just $143 million (2.3%) over fiscal year 2018-19. Coupled with the need to increase expenditures to respond to the public health crisis, this placed a huge stress on the City’s finances.

In the short term, this stress will cause disruption to projects and programs, as we have already seen, and set strategic initiatives back as funding is reduced. However, it should be noted that, as detailed later in the report, the City still has a treasury of well over $11 billion, almost $400 million in combined reserves, and a diverse revenue base which mitigates and spreads the impact of economic crises. Looking forward, the strength and speed of the City’s recovery depends on how the pandemic and the economy will unfold, and the projections are subject to an unusually high degree of uncertainty.

An interactive presentation of the report is available at:

The Preliminary Financial Report is organized in five distinct sections:

- Revenues and Expenditures: A discussion of the fiscal year that just ended, including trend analysis, notable changes from prior years, and financial performance relative to the Budget

- Reserve Fund: A discussion of the current condition of the City’s Reserve Fund, and analysis of the various factors influencing that figure

- Budget Stabilization Fund: A discussion of the Fund policy and how actual figures compare to the policy

- Bonded Indebtedness: A statement of the City’s total bonded indebtedness and debt service requirements; as well as comparisons to City policies and legal limitations.

- Recommendations: Strategic actions the City can take to best weather the recession and jumpstart the recovery.

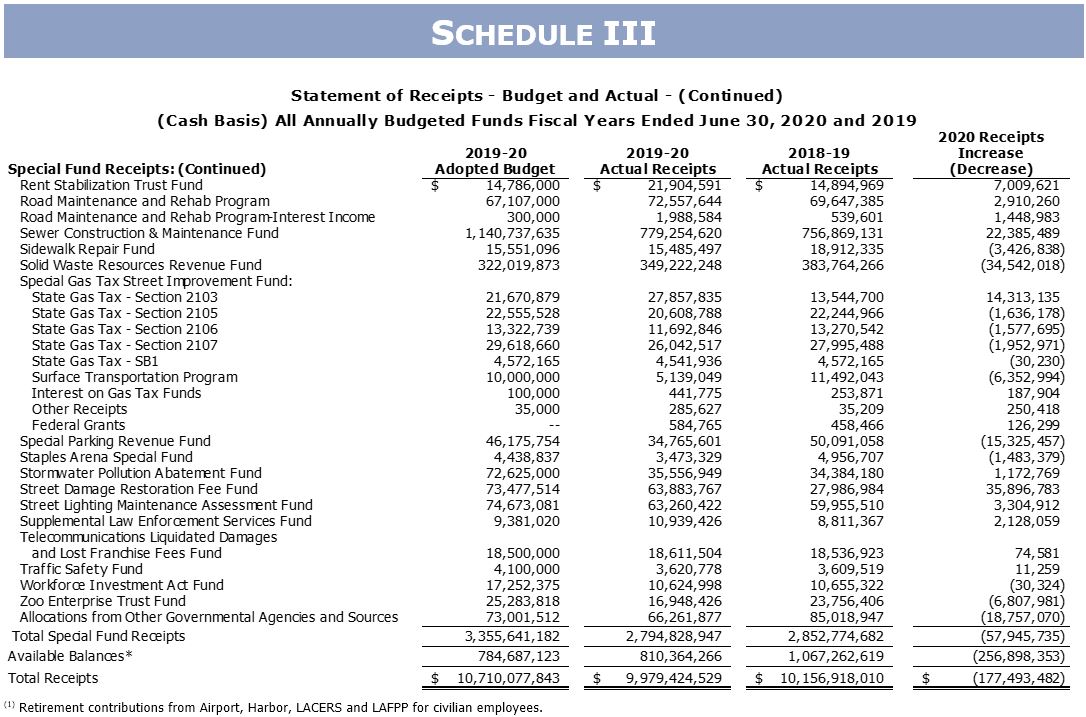

Uncertainty and Opportunity

Total Revenue grew by 0.9 percent over the prior year. Receipts from Property Tax, Business Tax, Licenses, Permits, Fees, and Fines, Electric Users’ Tax, Interest, and Grants were the only ones above last year’s receipts. While General Fund revenue increased by 4.5 percent for the first half of the year, the pandemic turned everything upside down, and we closed the year just 2.3 percent above last year, 3.0 percent below the budget. Revenue in budgeted special funds decreased by 2.0 percent year over year, 16.7 percent under budget.

Total expenditures and encumbrances grew at a rate of 10.0 percent. Expenditures rose 8.8 percent, led by salary and capital improvement projects. Encumbrances increased 26.1 percent from June 30, 2019 to June 30, 2020.

In the first quarter of 2020, the pandemic and associated social distancing ended the longest expansion and triggered the deepest downturn in output and employment since World War II. Key industries, like travel and hospitality have fallen by more than 75 percent. Transient Occupancy Tax Revenue was affected the most, 22.4 percent or $73.1 million below the budget and 20.5 percent or $65.3 million less than last year.

In this rapidly evolving environment and unusually high degree of uncertainty, it is hard to forecast economic recovery, and this is a major risk to the 2020-21 Budget. Compounding Frequent and ongoing review of the Budget will be necessary throughout the year to monitor and maintain fiscal balance and to respond the challenge ahead.

Reserve Fund

The COVID-19 Pandemic proved once again that the key to preparing for future downturns is to increase the City’s reserves during years of strong growth. In the last ten fiscal years, with a combination of strong revenue growth and fiscal restraint, the Reserve Fund balance rose from 3.9 percent in 2009-10 to its 8.2 percent peak at the beginning of 2015-16, then declining to 6.2 percent in the 2019-20 Adopted General Fund Budget, still well above the 5 percent policy goal.

This policy was rewarded in 2019-20, as balancing the budget required the transfer of $195.5 million from the Reserve Fund to the General Fund. As a result, the Reserve Fund Balance started 2020-21 at 3.9 percent of the General Fund Budget, below the 5 percent policy level and almost as low as in 2010-11 in absolute terms, but at $262 million, still a significant resource as the City moves into 2020-21.

As the year progresses, the City will need to carefully monitor, and hopefully bolster, its reserves so that funds are available to mitigate the impact of future events.

Budget Stabilization Fund

The Budget Stabilization Fund (BSF) is the City’s mechanism for accumulating excess tax revenues in growth years in order to mitigate shortfalls in lean years. The June 30, 2020 balance in the Fund was $116.6 million. While the revenue estimates in the 2020-21 Budget would have allowed for a transfer from the BSF, none was taken, meaning that this money will still be available if needed to meet future needs.

Bonded Indebtedness

Bonded indebtedness and the City’s debt service obligations increased slightly due to the issuance of MICLA-2019 Street Lights Financing bonds. Debt service payments increased as well, from 5.5 percent to 5.6 percent of General Fund revenue, but are still well under the City’s 15 percent policy ceiling.

This low level of debt, combined with historically low interest rates, presents the possibility of utilizing this capacity to invest in the City’s many infrastructure needs. If the City were to undertake a large capital program, it could meet critical needs for facility and infrastructure repair and replacement, serve as a much-needed economic stimulus and jobs creator, and provide an opportunity to strategically invest in communities across the City that have historically missed out on opportunities, especially during economic disruptions.

Recommendations

Based on the information provided in this report, and based on our knowledge and understanding of recessions and recoveries in years past, we make the following recommendations:

- Optimize the City’s revenue streams and rein in spending;

- Begin Rebuilding the City’s Reserve Fund;

- Leverage the City’s numerous assets, including real property, talented people, and numerous special funds, to get the most out of what we have; and,

- Strongly consider a large expansion of the City’s capital program, focusing on critical needs as well as strategic opportunities to invest in historically disadvantaged neighborhoods and people.

Section I: Revenues and Expenditures

Total Revenues in budgeted funds for 2019-20 were $9.17 billion, an increase of 0.9 percent over 2018-19, while total expenditures (excluding encumbrances) increased by 8.8 percent to $8.95 billion, which includes $441 million payments of prior year’s encumbrances. In addition to the expenditures, the City had $779.2 million encumbered as of June 30, 2020.

Exhibit 1 shows the ten-year history of total revenues and expenditures.

Since 2010-11, revenues have grown by 41.5 percent (average annual growth of 4.0 percent), while expenditures have grown by 49.1 percent (average annual growth of 4.6 percent). As seen in Exhibit 1, revenues have consistently exceeded expenditures. Most of this excess has been in the City’s many budgeted special funds. The surplus in the General Fund has been a much smaller portion of the total, but still has allowed the City to grow the Reserve and Budget Stabilization Funds.

It is critical to note that, while revenues continued to exceed expenditures in 2019-20, the surplus shrank significantly due to slow revenue growth and higher than usual expenditure growth. More detail on these results is provided below.

The 2019-20 Budget totaled $9.93 billion (excluding $784.7 million in available balances), of which $6.57 billion was in the General Fund and $3.36 billion was in Special Funds. Actual receipts for the year (excluding available balances) were $9.17 billion, 7.6 percent less than budgeted, while total expenditures (including encumbrances) were $9.73 billion, 9.2 percent less than budgeted. Detail of budgeted and actual receipts and expenditures is presented in Schedules III and IV.

General Fund Revenues

The General Fund is the primary operating fund of the City. It is used to account for all financial resources except those legally required to be accounted for in other funds. General Fund revenues are derived from such sources as taxes, licenses, permits, fees, fines, intergovernmental revenues, charges for services, special assessments, and interest income. Exhibit 2 presents 2019-20 actual General Fund revenues by percentage.

Actual 2019-20 General Fund receipts totaled $6.37 billion, $195.5 million (3.0 percent) less than the Budget and $143.1 million (2.3 percent) more than 2018-19. Over the past five years, General Fund revenue averaged 4.5 percent growth, exceeding the Budget twice and coming up short three times, though 2019-20 is the only year in this series where the actuals were significantly different from the budget. Exhibit 3 presents a comparison between adopted and actual General Fund receipts by fiscal year.

The General Fund revenues that outperformed the Budget in 2019-20 were Gas User’s Tax ($10.5 million or 16.6 percent), Franchise Income ($3.8 million or 4.7 percent), Interest Income ($9.7 million or 26.5 percent), and Grant Receipts ($2.7 million or 17.0 percent).

Property Tax receipts exceeded expectations due to another year of strong growth in assessed property values, $121.8 million (6.1 percent) higher than 2019 receipts. Ex-CRA property tax increment revenue was $16.3 million less than budget but $10.1 million more than the prior year.

The Budget assumed 9 percent growth for Business Tax receipts, and actual receipts were 8.7 percent or $52.7 million higher than last year, just 0.2 percent or $1.3 million lower than the Budget. Recreational cannabis retail activity exceeded expectations by $2.1 million (2.8 percent), generating $78.3 million (11.9 percent of total business taxes), even though cash payments for recreational cannabis business taxes were not accepted after March due to COVID-19 facility closures. Meanwhile non-cannabis business tax actual receipts of $577.6 million, were 0.6 percent or $3.4 million lower than the budget, and 3.2 percent or $18.0 million more than last year. Due to the timing of the business tax, which is due in February for activity in the prior calendar year, the anticipated negative impact of COVID-19 on non-cannabis business tax will be seen in 2020-21 receipts.

Sales Tax Receipts were $12.6 million or 2.8 percent higher than last year as of the end of March, but ended $33.6 million or 5.7 percent less than the budget, and $25.2 million or 4.3 percent lower than last year. In addition to lower receipts associated with reduced economic activity, the Tax Deferment Program implemented by the State affected the collected revenues. It is hard to differentiate these two impacts, so we do not know how much of the reduced receipts will be recovered in future periods.

Franchise Income ended higher than budget by $3.8 million, mainly due to natural gas and Multi Family Solid waste fees that exceeded the budget by $1.4 and $2.9 million respectively.

Utility Users’ Tax had a net decrease of 0.9 percent. While Gas Users Tax exceeded the budget by $10.5 million due to delayed implementation of a legal settlement, Electrical Users and Telephone Users Taxes were $24.3 million under the budget (2.8 and 8.3 percent respectively). While Utility Users Tax has historically been considered economically sensitive, only the Electrical Users’ Tax has shown any correlation to larger economic trends in recent years.

Licenses, Permits, Fees and Fines ended $68.5 million or 6.1 percent higher than last year, but lower than the budget ($28.6 million or 2.3 percent). Somewhat surprisingly, departmental receipts (relating mainly to licenses, permits, and various service fees collected by departments) were strong, exceeding budgeted amounts. The main driver of the shortfall was a $49M shortfall in reimbursements from special funds, due mainly to vacant special-funded positions.

Transient Occupancy Tax (commonly known as Hotel Tax) receipts experienced the most dramatic impact from COVID-19, since travel and hospitality virtually stopped. While receipts were at or very slightly below 2018-19 during the first nine months, they dropped off over the last quarter, with May and June receipts more than 80 percent lower than the prior year. By year end, TOT was $73.1 million or 22.4 percent below budget and $65.3 million or 20.5 percent less than last year.

Exhibit 4 shows cumulative Transient Occupancy Tax monthly receipts for FY 2019 and FY 2020.

Unfortunately, TOT will also likely be the last revenue category to recover. Even as travel has ticked up slightly six month later, the hotel industry remains on the brink of collapse. The accommodations sector is left with a devastating unemployment rate of 38%, and cripplingly low occupancy rates of 38% in urban markets. How and when this sector recovers will be a defining factor in the City’s overall recovery.

Documentary Transfer Tax receipts were short $6.5 million or 3.1 percent compared to the budget and $738 thousand or 0.4 percent compared to last year. While the great recession was defined by the collapse of the real estate market, including a 60 percent drop in Documentary Transfer Tax receipts, the current recession has so far left this sector relatively untouched, with a short disruption in the spring due to social distancing requirements and near-complete recovery by July.

The Power Revenue Transfer was $5.7 million (2.4 percent) less than budget. It has been declining slowly since 2016, with a 3.6 percent average decrease over the last four years.

Exhibit 5 displays a 10-year history of General Fund receipts, excluding transfers from Reserve Fund.

Appropriations, Expenditures & Encumbrances

Total expenditures, including encumbrances, were $9.73 billion. This was $883.3 million or 10.0 percent higher than 2018-19, but $982.8 million or 9.2 percent lower than the Budget.

Exhibit 6 presents a comparison between the Budget, the final budget (which includes interim appropriations made during the year), and actual expenditures and encumbrances by fiscal year.

For the last five years total actual Expenditures and Encumbrances have grown by an average of 5.7 percent. For the same period, Salaries (excluding Library and Recreations and Parks) increased by 5.1 percent, and Services, Supplies, Equipment and Others by 9.8 percent. Salaries are made up of Sworn and Civilian Salaries, which increased by 4.5 and 7.4 percent respectively.

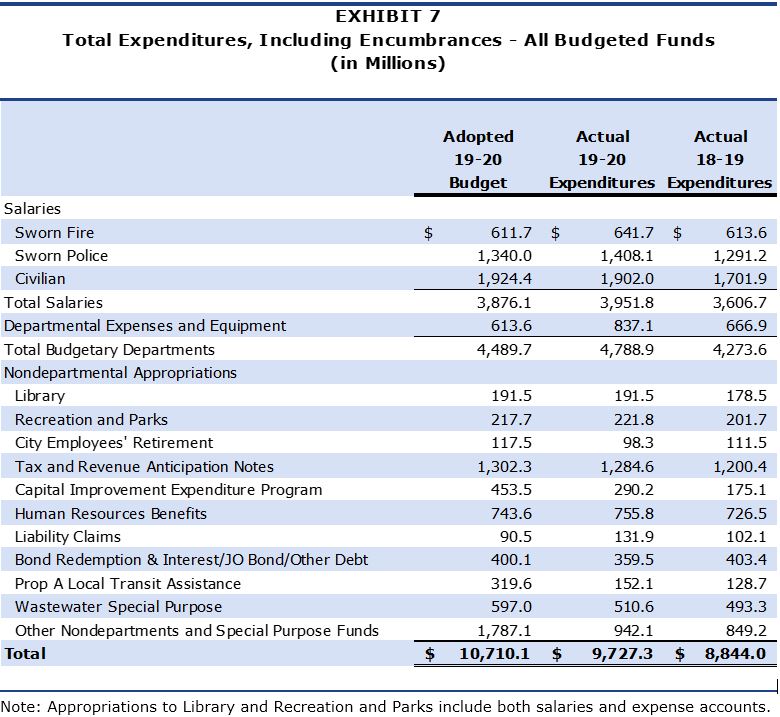

Exhibit 7 breaks out summarized categories of budgetary and actual expenditures and encumbrances for 2018-19 and 2019-20. Detailed information by department can be found in Schedule IV.

Salaries increased by $345.1 million or 9.6 percent compared to last year due to new labor agreements that didn’t materialize in the last year because of the timing of execution of those agreements. On account of retroactive nature of some of those agreements, the impact anticipated in 2018-19 was part of 2019-20 salary growth.

Total contributions to Library and Recreation and Parks, which increased by a $13.0 million or 7.3 percent and $20.1 million or 10.0 percent respectively, are made pursuant to Charter requirements and are tied to growth in the City’s total assessed valuation.

Capital Improvement Expenditure Program (CIEP) expenditures were 36.0 percent or $163.3 million lower than budget, but $115.1 million higher than the prior year. The largest increase from was in Refuse Collection and Disposal System Projects funded by new Green Bonds issued in 2018.

Human Resources Benefits expenses were $12.2 million or 1.6 percent above the budget, and higher by $29.3 million or 4.0 percent compared to last year. The increase was primarily due to increases in Health care subsidies for civilian and sworn employees, by $11.8 million or 2.4 percent, and Worker’s Compensation costs, which increased by $14.8 million or 7.5 percent.

Exhibit 8 breaks out expenditures and encumbrances by Governmental Activity.

Almost a third of total expenditures were spent on Protection of Persons and Property. Even as priorities have shifted and the economy has expanded, this percentage has remained remarkably stable.

Also of note were the contributions to the City’s pension systems, which totaled $1.4 billion, 14.1 percent of total spending. This is up slightly from the prior year, and is expected to increase again as the impact of the market volatility is absorbed into the systems’ actuarial models. To the extent that the City is able to hold salary expenditures under long-term averages, the increase will be mitigated, but this issues should be monitored carefully.

The City ended the fiscal year with a total of $779.2 million in encumbrances: $541.8 million in the General Fund and $237.4 million in special funds. $246.9 million was encumbered for salaries to be paid in July 2020, with the balance encumbered in expense, equipment, and special fund project accounts.

Encumbered funds for salaries are earmarked for the last pay period of the fiscal year and unspent funds are immediately released after payroll is made. Funds encumbered for expense accounts are continued across fiscal years to ensure that cash is available to cover the expenditure when it is made. Schedule V provides a listing of General Fund encumbrances by department.

The General Fund Encumbrance Policy provides that encumbered funds that remain unspent for a period longer than one fiscal year shall be disencumbered every fiscal year, with the exception of capital project funds. Prior-year encumbrances are automatically disencumbered unless exempted by Mayor and Council approval. As part of the 2019-20 Year-End Financial Status Report, a total of $57.1 million was exempted from disencumbrances, an increase of $18.2 million from last year’s exemptions. As noted in past years, this is an issue which deserves more attention.

Unencumbered General funds revert to the Reserve Fund at year end. As such, exemptions to the automatic disencumbrance policy reduce reversions, thereby reducing the cash available in the Reserve Fund to pay for emergencies and contingencies. Section II below discusses the status of the Reserve Fund in more detail.

Section II: Reserve Fund

The Reserve Fund is established to ensure that funds are available for unanticipated expenditures and revenue shortfalls in the General Fund, and is broken into an Emergency Account and a Contingency Account.

The Emergency Reserve Account is fixed at 2.75 percent of the adopted General Fund receipts. A finding of urgent economic necessity is required to use these funds. The Contingency Reserve Account includes all monies in the Reserve Fund over and above the amount required to be allocated to the Emergency Account. Contingency Reserve Account funds can be a source of additional funding to cover unanticipated expenses or revenue shortfalls.

The City’s Reserve Fund Policy (CF 98-0459) sets a Reserve Fund cash balance goal of at least 5.0 percent of budgeted General Fund receipts. Exhibit 9 displays the past ten years of beginning Emergency and Contingency Reserve Fund balances compared to this policy target.

The Reserve Fund is an important measure of the City’s fiscal health, and is vital to cash flow, bond ratings, and the ability to manage financial challenges.

Failure to maintain the City’s Reserve Fund at an adequate level not only exposes the City to significant risk in the event of an emergency, but can also have negative financial impacts due to increased cost of borrowing. The City proved the worth of strong reserves in 2019-20, when much of the built-up reserves were used to make up for revenue shortfalls. However, to date there has not been any negative feedback from rating agencies, as they have been focused more on the City’s ample liquidity and strong fiscal management.

Reserve Fund Status

After the 2019-20 accounting close, budgetary appropriations, return of advances, and reappropriations, the fiscal year-start adjusted Reserve Fund balance was $262.5 million or 3.93 percent of General Fund receipts anticipated in the 2020-21 Budget, $71.8 million below the 5.0 percent Reserve Fund Policy goal.

Exhibit 10 shows Adopted and Actual Beginning Reserve Fund Balances for last ten years.

The Reserve Fund balance increased significantly from 2011-12 to 2015-16, hitting 8.18 percent in 2015-16. From 2016-17 to 2019-20, the percentage varied in the 5.5 to 6 percent range, less than prior years but still above the policy minimum. While the 2020-21 amount is significantly less than previous years, it is $19.8 million higher than the $242.7 million assumed in the Budget, primarily due to General Fund revenue finishing the year better than projected in the Budget.

The Reserve Fund balance increased significantly from 2011-12 to 2015-16, hitting 8.18 percent in 2015-16. From 2016-17 to 2019-20, the percentage varied in the 5.5 to 6 percent range, less than prior years but still above the policy minimum. While the 2020-21 amount is significantly less than previous years, it is $19.8 million higher than the $242.7 million assumed in the Budget, primarily due to General Fund revenue finishing the year better than projected in the Budget.

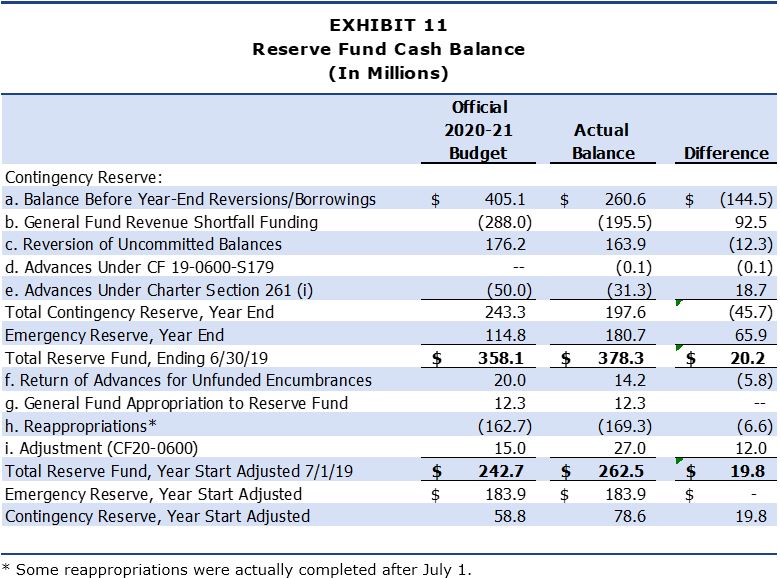

Adjustments to the Reserve Fund Cash Balance

At the end of each fiscal year and the beginning of the next, a number of transactions are required to accurately reflect the status of the Reserve Fund through the closing of the City’s books. Exhibit 11 details the year-end and year-start adjustments to the Reserve Fund Cash Balance, comparing Budget versus actual.

Following are descriptions of the line item changes to the Reserve Fund listed in Exhibit 11:

Reserve Fund Cash Balance (June 30, 2020)

As of June 30, 2020, after closing the City’s General Ledger, the recorded Reserve Fund balance was $262.5 million. This was $19.8 million more than the amount anticipated in the 2020-21 Budget. The Reserve Fund cash balance is adjusted by the following factors to arrive at the year-end balance:

a. Balance Before Year-End Reversions/Borrowings

The amount of cash available in the Contingency Reserve prior to adjustments for year-end reversions, unallocated revenues, and borrowings. It does not include cash in the Emergency Reserve. For 2019-20, this amount was lower than anticipated in the budget due to higher than anticipated advances and non-reimbursable transfers to other funds made after the adoption of the budget.

b. General Fund Revenue Shortfall Funding

As part of the Year-End Financial Status Report (C.F. 19-0600-S180), the Council authorized the Controller to transfer up to $288 million from the Reserve Fund to fully fund appropriations. The actual shortfall was $195.5 million, which was transferred from the Reserve Fund.

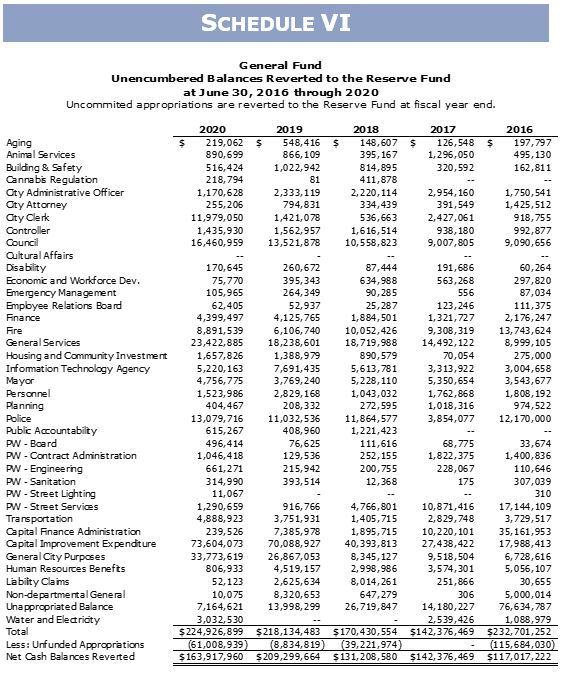

c. Reversion of Uncommitted Balances

Uncommitted General Fund appropriations are reverted to the Reserve Fund at fiscal year-end. Appropriations (spending authority) granted to City departments by the Mayor and Council are committed throughout the year in the form of encumbrances and expenditures. Remaining or uncommitted balances are reverted to the Reserve Fund to the extent that there is available cash in the General Fund.

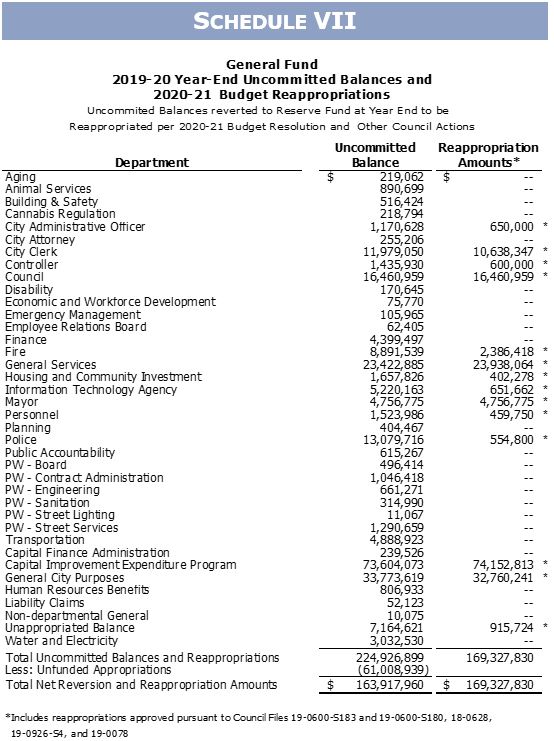

In 2019-20, the budget estimated $176.2 million in reversions. The uncommitted balance at year end was $224.9 million. Excluding unfunded appropriations, a total of $163.9 million reverted to the Reserve Fund. For a detailed breakdown of uncommitted balances by department, please see Schedule VII.

d. Advances Under CF 19-0600-S179

Council File 19-0600-S179 authorized the Controller to borrow from the Reserve Fund at year-end to balance departmental budgets where needed in order to facilitate the closing of the City’s General Ledger. The Controller is authorized to increase appropriations within established limits without getting itemized Mayor and Council approval, a process that would delay the closing of the City’s General Ledger. An advance of $500 was made to the General Services department.

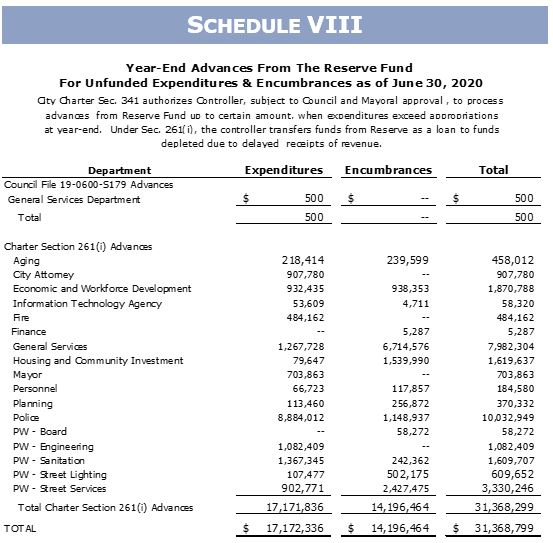

e. Advances Under Charter Section 261(i) for Unfunded Encumbrances and Expenditures

Under Charter Section 261(i), the Controller transfers funds from the Reserve Fund as a loan to any fund that becomes depleted due to tardy receipt of revenue. The 2020-21 Budget estimated $50.0 million in year-end advances. Actual advances were $31.3 million, consisting of $17.1 million in unfunded expenditures and $14.2 million in unfunded encumbrances. See Schedule VIII for a breakdown by department.

Unfunded expenditures generally occur when expenditures occur prior to receipts (e.g. grants on reimbursement basis) and/or due to billing delays. When the funding source reimburses the costs, departments are able to repay the advances. If funding is not available, departments may request Mayor and Council approval to write-off the advances. Unfunded encumbered amounts represent a technical adjustment at year-end and are reversed at the start of the new fiscal year as documented in item (f), below.

Reserve Fund Cash Balance (2020-21 Year-Start)

The 2019-20 year-end Reserve Fund cash balance is not the same as the 2020-21 year-start cash balance. The following technical adjustments are made after the close of the prior fiscal year.

f. Return of Advances for Unfunded Encumbrances

Advances for unfunded encumbrances are reversed at the start of the following fiscal year, as discussed in item (e), above.

g. General Fund Appropriation to Reserve Fund

The 2020-21 Budget included an appropriation to the Reserve Fund totaling $12,343,213.

h. Reappropriations

The 2020-21 Budget and other Council actions (C.F. 19-0600-S180, 19-0600-S183, 19-0926-S4, 19-0078, and 18-0628) provided that certain uncommitted balances earmarked for specific programs would be reappropriated in the subsequent year if not expended by the year-end. See Schedule VII for reappropriations by department. Actual reappropriations of $169.3 million were $6.6 million above the estimated $162.7 million budget.

i. Adjustment

Historically, the Budget reflects the City Council’s changes to the Mayor’s Proposed Budget. As the City council did not approve or modify the Mayor’s Proposed Budget before June 1, 2020, it became the 2020-21 City budget pursuant to Charter Section 313. The City Council and the Mayor, however, approved various adjustments to the Budget on July 1, 2020. The Controller was instructed to transfer $20 million from fund 63M (COVID-19 Federal Relief Fund) as a reimbursement of the funds transferred to the COVID-19 Emergency Response Account in the General City Purposes Budget (CF 20-0147 Motion No. 72). Also approved in that action was an early reversion of $7 million from the Unappropriated Balance account for General Municipal Elections 2020 to the Reserve Fund.

Section III: Budget Stabilization Fund

The Budget Stabilization Fund (BSF) was added to the City’s Charter in 2011. The purpose of this fund is to set aside revenues during periods of robust economic growth or when revenue projections are exceeded to help smooth out years when revenue is stagnant or is in decline. The BSF does not have a minimum balance that it must maintain.

The June 30 Fund balance was $116.6 million. Exhibit 12 displays the adopted and prior year cash balance and adjustments of the BSF. The Budget of 2019-20 included a deposit of $7.0 million into the Fund, but there is none for 2020-21.

The current BSF Policy (approved January 21, 2020) states that a budget appropriation shall be included as part of the Budget for the following fiscal year when the anticipated growth in combined receipts from seven City “economically sensitive” revenue categories (Property Tax, Utility Users Tax, Business Tax, Sales Tax, Documentary Transfer Tax, Transient Occupancy Tax, and Parking Users Tax) exceeds the growth threshold. For each five-tenths of one percent that the anticipated growth exceeds the growth threshold, the amount of the required appropriation to the BSF shall be equal to five percent of the value of the anticipated excess growth. The maximum appropriation shall be equivalent to 25 percent of the value of the growth above the growth threshold. For Fiscal Year 2020-21, the growth rate used to determine BSF contributions was recalculated to be 4.3 percent, based on the 20-year historical average of these tax revenues.

The current BSF Policy (approved January 21, 2020) states that a budget appropriation shall be included as part of the Budget for the following fiscal year when the anticipated growth in combined receipts from seven City “economically sensitive” revenue categories (Property Tax, Utility Users Tax, Business Tax, Sales Tax, Documentary Transfer Tax, Transient Occupancy Tax, and Parking Users Tax) exceeds the growth threshold. For each five-tenths of one percent that the anticipated growth exceeds the growth threshold, the amount of the required appropriation to the BSF shall be equal to five percent of the value of the anticipated excess growth. The maximum appropriation shall be equivalent to 25 percent of the value of the growth above the growth threshold. For Fiscal Year 2020-21, the growth rate used to determine BSF contributions was recalculated to be 4.3 percent, based on the 20-year historical average of these tax revenues.

The required deposit to the BSF may be forgone completely in the case that the City Council and Mayor declare a fiscal emergency or suspend the BSF funding policy based on findings that it is in the best interest of the City to suspend the policy. Mid-year deposits to the BSF or deposits above the required amount may be authorized by the City Council, subject to the approval of the Mayor, at any time during the year from various General Fund sources. Consideration should be given to depositing unanticipated and unbudgeted receipts that are not otherwise required to balance the current year budget.

Section IV: Bonded Indebtedness

The City’s Debt Management Policy establishes guidelines for the structure and management of the City’s debt obligations. These guidelines include target and ceiling levels for certain debt ratios to be used for planning purposes. The two most significant ratios are a non-voter-approved debt service cap as a percent of General Fund revenues of 6 percent and a total debt service cap as a percent of General Fund revenues of 15 percent.

Council File 20-0161, dated September 23, 2020, approved revisions to the Debt Management Policy. There is no impact to the City’s debt levels or capacity resulting from the adoption of the revised Debt management Policy, as the changes were mainly to conform with changes in the municipal debt market.

Exhibit 13 illustrates the City’s compliance with these debt management policies for the past five years.

The actual ratio of Debt Service to General Fund Receipts was 5.6 percent in 2019-20. The ratio increased because the first Principal payment for Series 2018-A General Obligation Bonds, issued in 2018-19, was due in current year. This issuance provided funds in the amount of $276.2 million for Proposition HHH Housing and Homeless Facilities projects. Schedule IX shows the details of Outstanding General Obligation Bonded Debt.

Exhibit 13 above shows very clearly the responsibility the City has exhibited when it comes to debt management. Good administration of debt service obligations has put the City in a position to consider major projects, as well as making strategic financing agreements available when these present financial advantages.

This significant amount of debt capacity also indicates an opportunity to invest in large-scale long-term infrastructure projects, including both facility repair and replacement as well as new projects designed to stimulate economic development. Such an investment would also provide an opportunity to focus on regional equity, focusing investment in areas of the City which have often been left behind in prior initiatives. More generally, a significantly expanded capital program would serve as a fiscal stimulus for the entire region, adding jobs to a struggling economy and providing the infrastructure for future opportunity.

Section V: Recommendations

The current crisis demands decisive action on the part of the City’s leaders, who must simultaneously consider how to balance the City’s books in the short term and how to position the City to benefit in the long term. To this end, we make the following recommendations:

- Optimize the City’s revenue and rein in spending. With the current recession having brought the travel and hospitality industries down by 70 to 80 percent, and funding streams related to parking and retail sales showing signs of significant slowdown, the City must work to get the most out of the revenue streams that are still coming in. At the same time, we must work together to find the least disruptive possible ways of reducing, or at least curtailing increases in, our spending.

- Begin rebuilding the City’s Reserve Fund. Fiscal Year 2019-20 was a textbook example of why strong reserves are a critical piece of economic resilience. If the City had not spent the last decade building the Reserve Fund up above the 5 percent policy threshold, much more dramatic cuts would have been necessary right away, and our current position would be much more precarious. The time is now to start planning on how to begin growing these reserves again.

- Leverage the City’s numerous assets. The City has vast resources of real property, talented people, and numerous special funds. All of these represent opportunities to develop and grow out of this recession. The alternative is to leave things as they are, ensuring that our recovery, and our City, will be less than it could be.

- Strongly consider a large expansion of the City’s capital program, focusing on critical needs as well as strategic opportunities to invest in historically disadvantaged neighborhoods and people. As discussed in the section on Bonded Indebtedness, the City has legal capacity to borrow more than $8 billion for capital projects. While it would be unwise to ever use all, or even most, of this capacity, a significant investment in our infrastructure and our communities would reap benefits for generations to come.

Schedules I - V

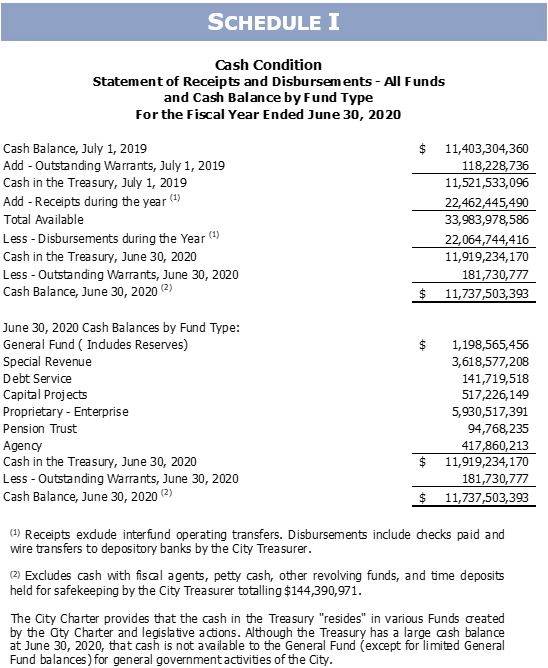

Schedule I: Cash Condition Statement of Receipts and Disbursements

Schedule II: Reserve Fund Statement of Receipts and Disbursements

Schedule III: Statement of Receipts – Budget and Actual (Cash Basis) – All Annually budgeted Funds

Schedule IV: Statement of Budget Appropriations, Expenditures and Encumbrances Budget and Actual (Cash-Basis) – All Annually Budgeted Funds

Schedule V: Year-end Encumbrances – General Fund

Schedules VI - X

Schedule VI: General Fund Unencumbered Balances Reverted to the Reserve Fund

Schedule VII: General Fund Year-End Uncommitted Balances and Adopted Budget Reappropriations

Schedule VIII: Year-End Advances from the Reserve Fund for Unfunded Expenditures and Encumbrances

Schedule IX: Statement of General Obligation Bonded Debt

Schedule X: Ratio of Debt Service Requirement to General Fund Receipts Last Ten Fiscal Years